Средне и краткосрочный технический анализ

The Dynamic Trading Approach

Economic Days

While common sense would lead us to use only empirical

results, i.e. business day observations, can we assume that volatility is the same day in and day out? Obviously not. On some days markets move more than on other days. We will call these days «Economic Days», where a corporate buyout or natural disaster fundamentally impacts the price of an asset.

On most davs. market volatility will be low since substantial «Economic Days» do not occur that often. The overall price movement (volatility) that will occur in any market will simply be the summation of all price movements both subdued and extreme. When the analvst is forecasting volatility, he cannot do so blindly. He must adjust his projections based on the number of «Economic Days» that have already occurred over his sample period. After counting the «Economic Days» that have already occurred, he will have a better feel for the remaining number of expected «Economic Days». While we can never be certain of what may occur, applying simple principles of probability can provide insights.

Vocabulary

common sense — здравый смысл,

day in day out — изо дня в день,

ai

buyout —выкуп, приобретение

контрольного пакета акций,

i

to impact —влиять,

It's all about PROFITS

Reiving only on chart support and resistance is not very effective, as these levels can be penetrated easily in strong trending markets and often leave the analyst feeling 'lost' when the price enters uncharted territory. Most intra-day players do not care whether the greenback closes higher or lower in the US, as they only trade between 8:00am and 5:00pm during their own time

zone. Projected targets that are 150—300 points away from the current rate are therefore of no practical interest to them. While the direction of major trend is important. what an intra-dav trader needs is an approach that will enable him to profit continuously on normal trading days. In an uptrend, for example, a 50 to 80 point rise may be followed by a 20—30 point pullback and then another rise of 60—80 points. The secret is to develop a method by which one can buy on such pullbacks, get the profit and exit in time. I sincerely believe that the Dynamic Trading Approach does just that by capturing the ups and downs of intra-day as well as day to day moves. It has worked for us in forecasting the market moves with 65—70 per cent accuracy (3 to 5 intra-day and 1 —2 daily forecasts every trading day over the last 8 years).

л to subdue —ослаблять,

a: sample —образец,

i ' insight — проникновение во что-либо, интуиция

е projected targets —проецируемые цели

At the beginning of December 1995 dollar/DM broke above 1.4435. But the resistance at 1.4580 proved to be too strong. The subsequent retracement from this area helped to build uptrend pressure. Another assault on the upside is possible.

In January a break above the 1.4545/80 zone is likely to trigger a rally to 1.5045 with the medium term objective of 1.56/1.58.

Dips will find support in the 1.428/65 band.

Recommendation Hold longs and add on dips to 1.4340/00. Keep the stop/reverse below 1.4265/60. Cover longs on rallies to 1.4545/1.48.

Loss of 1.4265 will indicate a correction towards the 1.40/1.38 area. Reinstate longs here, stop/reverse below 1.37—for 1.3455.

USD/DEM technical commentary (31 JAN—01 MAR 96) 31 Jan 96 Dollar/DM keeps entrenched within the recent consolidation range. Immediate upside pressure is intact. Further consolidation within the range is not out of the question. Near term support for dips is centered on the 1.4850 pivot. A test of the 1.4935/40 peak may be triggered by a break above 1.4915.

01 Feb. 96 Pressure is preserved on the upside. If good support

ei

to retrace

— возвращаться

assault

— атака, штурм

i: ei

to reinstate

— восстанавливать

e

to entrench

— закрепиться

ou

to provoke

— вызвать

ei

to sustain

— поддержать

л

vulnerable

— уязвимый

in the 1.4785/ 65 zone is held, immediate upside potential will be intact. A break above 1.4915 will provoke a test of the 1.4935/40 peak and sustain acceleration to 1.4990, the 1.5045.

05 Feb. 96 A test of the 1.4735/15 support band is possible. It is a result of sharp reversal from the 1.4915 area. To ease corrective pressure, a break back above the 1.4835/50 band is needed. The market will be left vulnerable to a deeper correction if the 1.4835/15 band is not held.

06 Feb. 96 A deeper sell off may be prevented if the USD/DEM correction holds over 1.4580/1.4605 area. Immediate downward pressure will be alleviated by a break back above 1.4740/50. A rally through 1.4785 will confirm a resumption of the uptrend towards 1.4850,1.4915.

07 Feb. 96 USD/DEM sustains the end of the corrective phase and the resumption of the uptrend towards 1.4850, 1.4915. 1.4605 has been held. There is a potential for failure at 1.4785.

08 Feb. 96 USD/DEM broke above the 1.4755/85 band and continues its stady advance. Near term support is now at 1.4745/35. The end of the corrective phase is confirmed with 1.4910/15 initial target.

i:

to alleviate

— ослаблять

i

'interim

— временный

12 Feb. 96 There is a risk of another downside leg towards pivotal support in the 1.4605/1.4580 band. A break below 1.4710 may trigger such a drop. There will be light resistance for rallies at 1.4785. A recovery beyond 1.4825 will indicate a resumption of the uptrend to 1.4955. Now USD/DEM is still entrenched in its consolidation range.

19 Feb. 96 The market is vulnerable to a much deeper retracement towards 1.4280/65. Interim support is centred on the 1.4385/75 band.

22 Feb. 96 USD/DEM remains under short term downward pressure as long as the 1.4610/35 band caps. Some consolidation within a 1.4605-1.4405 range is possible ahead of a retest of the downside.

26 Feb. 96 USD/DEM is pinned within its consolidation range as long as the 1.4605/35 zone caps. Overall pressure is on the downside.

27 Feb. 96 USD/DEM has held well on the downside in the 1.4430/05 area over the last few days and continues to oscillate within its narrowing range with parameters to day of 1.4575 — 1.4430. With a break above 1.4575/85 there is now room for a test of upper resistance levels.

01 Mar. 96 USD/DEM has achieved the initial target area of 1.4745/75 and maintained upward pressure. A break of this zone will lead to some consolidation with 1.4825 the next objective. The pivotal 1.4650/95 band will give good support to dips.

о to oscillate

— колебаться

0:

to balk

— задерживать

Sterling- Dollar Jan 1996) Medium Term Outlook

Sterling long term uptrend is now complete, confirming the start of a consolidation phase. The market will be under overall pressure as long as the 1.5685/1.5715 area continues to cap. The medium term objective is 1.46/1.45. A downtrend may be triggered by a break back below 1.52.

Recommendation

Hold short, add on any rallies to 1.5610, 1.5685, stop/reverse over 1.5715. Cover shorts on dips to 1.52/ 5180, reinstating on a break, looking for 1.46/1.45 to cover. A break above 1.5685/1.5705 may provoke a resumption of neutral consolidation below 1.5855/80. Reinstate shorts in this zone, stop/reverse above for 1.6240/50.

Exercises

Ex. 1. Put questions to the underlined words.

Ex. 2. Read and translate the articles.

Ex. 3. Learn the noun and verb collocations of the technical commentary. Make your own commentary of the

USD/DEM moves of the missing dates of the chart (08—27 FEB 96). Ex. 4. Translate from Russian into English in writing and then from English into Russian orally.

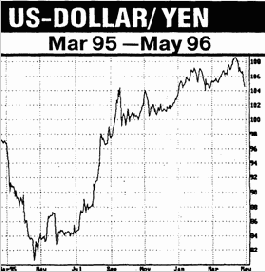

ПАДЕНИЕ ДОЛЛАРА (МАРТ 95)

Западные рынки на прошлой неделе перенесли самый большой шок — 8 марта были побиты все рекорды послевоенного времени — доллар рухнул до уровня 1,3450 по отношению к немецкой марке и до 88,65 по отношению к японской иене. На фоне истерических продаж доллара

единственными покупателями выступали центральные банки. Дилеры использовали эти возможности для дальнейших продаж.

Последовавшие за этим заявки на покупку долларов за иены сдвинули немецкую марку, которая перешла в коридор 1,3700-50.

Затем представитель Бундесбанка, заявил, что "им

Есть куда опускать ставку немецкой марки". Это подтолкнуло доллар к 1,3850 и дальше к 1,4000. Это движение потянуло за собой и курс японской иены, которая отошла от опасного уровня 90,50.

В ближайшее время можно предложить два сценария развития событий. Первый предполагает, что, если доллару удастся удержаться выше отметки 1,3850, то давление марки будет исчерпано, и доллар может начать расти. Второй сценарий предусматривает резкий откат к уровням 1,4220-50 или даже к 1,4340, которые приведут к росту спекулятивных настроений. Курс может вновь рухнуть к 1,3660. А если рынку помогут какие-нибудь слухи, то и "дальше — к 1,3500 и 1,3250.

Другими словами, взлет доллара неминуем.

Естественно, что и наличные марка с иеной на прошлой неделе сильно подорожали в западных банках. Курсы покупки/продажи за неделю изменились по марке с 1,415/1,525 до 1,350/1,460, по иене с 93,60 до 87,45/93,45.

Vocabulary

Q11 dU.

падение — downfall

э:

побить рекорд — to surpass a record

л

рухнуть — to plummet

е

истерический — hysterical

i:

отходить — to retreat

о:

сценарий — scenario

buying ~

immediate ~

downside ~

upside ~

eased-

increased ~

preserved ~

•

kept-

uptrend / downtrend

to resume

bearish momentum

to renew

upward momentum

to foige ahead

upward pattern

upmove

upleg in the dollar

upside potential

upside target

target (objective)

to target 1.55

next-

to maintain

down side -

to attain

up side ~

initial ~

projected ~

overall ~

major ~

strength/weakness

to trigger

recent ~

corrective ~

short term ~

zone/base

to maintain scope

area/scope

to hold area

range/band

to break area

trading

to keep the range intact

consolidation

support zone

market

outlook

bearish

technical

retracement

to represent retracement

rebound

to prompt r.

break

to sustain b.

-lower to

- above

~ through

~ below

~ beyond

~ before

-after

initial ~

clear ~

rally, rise

to rally

recovery

to start

advance

to cause

overnight ~

to break to a new rally high

good ~

to attempt

~ back above

to reassert

-effort

decline

to trigger declines

pullback

stability

correction

•

deep-

low (point)

to match the peak

all time -

Mgh (point)

to test

peak

to retest

to attain

7 month high

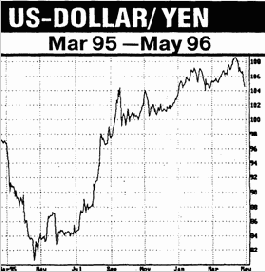

Dollar—yen Jan. 1996)

Medium Term Outlook.

The end of the four- month old consolidation phase indicates the start of the uptrend towards the 120 long term objective. Overall pressure to the top side may trigger a break above the 1995 peak of 104.70 followed by an acceleration to 106.60/65 then to the medium term target area of 111/113.60 Dips will find now support at 103, 101,50.

Recommendation

Hold longs, add on dips to 103/ 101.50, stop/reverse below 100.50. Add to longs on a break above 104.70, looking for 105.50, then to 106.60/65 area. Cover all longs on rallies to this target.

USD/JPY technical commentary (06—11 Mar. 1996)

06 Mar. 96 USD/JPY is entrenched in a consolidation range above good support at 104.85. Abreak above 105.30 may trigger an upward move towards 105.85/106. A deeper retracement to 104.65/40 is a possibility with the loss of 104.85.

07 Mar. 96 Break above 105.30 has prompted upward move. A test of the 105.85/106 band is likely, triggering a rally to the significant pivotal area of 106.45/60. An eventual break will confirm a rally to 106.95, then to 107.55.

08 Mar. 96 USD/JPY remained pinned down within a tight consolidation range and failed to sustain upside move as far as the 105.85/106 area. Pivotal support is intact at 104.85. A break above 105.85 may confirm a resumption of the uptrend towards 106.45/60.

11 Mar. 96 USD/JPY has balked on initial test of the 106.40/80 band. A sharp pullback into the previous range was triggered by dense resistance. Pivotal short term support in the 105.05/104.85 band needs to hold to prevent a sell-off towards 103.65 pressure is building for a resumption of the up-trend towards 111/113 target.

NOUN

VERB

Support, resistance,

to hold over the area

(price line, point)

to challenge

minor S/R

to breach support

major S/R

to break resistance

light ~

to trigger correction

strong ~

to provoke acceleration

key-

to signal consolidation

good-

to balk at resistance

pivotal -

to center on

initial ~

to remain under pressure

immediate ~

to keep intact (potential)

attempted -

to confirm a test

term-

to sustain the break

near term -

to reverse longs

interim ~

to remain entrenched

watched price

to prevent a sell off

to reinstate shorts

to give room for recovery

S/R area

to find support

to ease pressure

dollar (rate)

retained its strength

(dollar) prices

to sank to the day's low

opened at... down...

was quoted at... down... from...

gained back

closed at...

rose to...

finished... lower at...

steadied against the yen

drifted lower VS...

pressure

selling ~

Содержание