Волновая теория Элиота

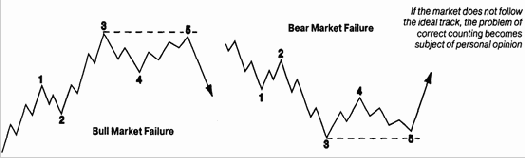

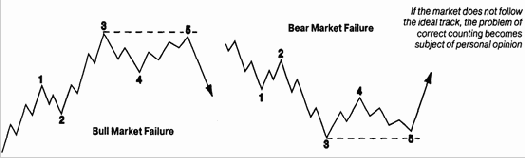

According to Elliott a rising stock market unfolds in five-wave/three-wave pattern and forms one complete bull market /bear market cycle of eight waves (1-3-5-B). The five-wave upward movement is called an impulse wave and the counter trend movement — a corrective wave. Waves 1, 3, 5 can subdivide into five waves of smaller scale. Corrective waves 2 and 4 can form three smaller waves each too. Impulse subwaves are numbered (1-2-3-4-5). Corrective subwaves are lettered (A,B,C). Thus waves in any series can be subdivided and resubdivided into waves of smaller degree or expanded into waves of larger degree.

The larger scale pattern

Vocabulary

ou to unfold — развертываться

i impulse — импульс, побуждение

ei scale — масштаб

se to expand — расширять

The analyst should take into consideration that in an uptrend market, the low of the second wave never goes below the beginning of the first wave. The third wave is never the shortest. The forth wave does not penetrate the price range of a first wave. Market movements are essentially the same but they may differ in the size or duration. Large scale movements incorporate smaller scale subdivisions which are similar to them in their «fractal» geometry. One of the three impulse subwaves (W-1, W-3, W-5) can have extensions i.e. elongated movements. These subdivisions increase the number of waves to nine for the main sequence. The increased number of movements does not change the technical significance of price pattern.

e to penetrate — проникать

э:

to incorporate — объединять

ae fractal "geometry" — «геометрия частей» фрактальная геометрия

TRANSLATION PRACTICE

Elliott wave theory

According to Elliott, markets move in cyclical waves, with a kind ofself-similaritv within the waves. The big waves consist of smaller waves which themselves contain smaller waves and so on. The names of the waves according to their size are as follows, with increasing length in time and amount:

sub-minuette

minuette [mmjuet]

minute [minit]

minor

intermediate

primary

cycle

super cycle

grand supercycle

The time frame starts with minutes and even single trades and ends in movements lasting for several hundred years from beginning to end. A complete cycle on one stage of observation consists of several movements, of which some are in the direction of the wave and some are in the opposite.

Now let us listen to Elliott himself:

"The rules to be derived... are:

1) Waves in the direction of the main movement, or the odd numbered waves, are made up of five lesser waves.

2) Corrective waves, or waves against the main movement (even numbered waves) are made up of three lesser waves."

The basic concept states that this structure is repeated at the next level of waves again, like the movement of (2) to (3), while consisting of five waves itself, is part of the next-state movement towards (1). The system is thus valid on all possible levels of observation and the only problem the analyst has to solve is correct wave countine.

odd numbered - нечетные (числа)

even numbered — четные (числа)

to stretch — растягивать

i:

to proceed - проходить

э:

distortion — искажение

e

irregular — неправильный, нерегулярный

Since markets do not move in the ideal way. some correction might fail to close above the previous correction's low, (in an upward trend like above), some of the odd moves might fail in closing above the previous odd-waves top and so on. These distortions make wave-detecting and wave-counting quite difficult and subject to personal opinion, which is the main problem when one tries to computerize the system. The main interest of the investor is always the fifth wave since it indicates a turnaround of the trend. "Sometimes the fifth wave will 'stretch', that is, deploy or spread out. The fifth wave. instead of proceeding in the normal one-wave pattern of the same degree as the movement as a whole, simply stretches or sub-divides into five waves of lower degree... Such spreading out is a characteristic of markets that are unusually strong (or weak, if a down movement.)"

invalidity

long run

bet

неправомерность — большой срок

- пари

For distortions of the ideal structure. Elliott formed a consistent system of triangles, diagonals, irregular corrections and wave extensions. Since distorted waves can follow each other, their detection becomes extremely difficult-to-read. And

this is the reason why Elliott could make surprising and extremely accurate predictions on the one hand at times. whereas he failed at others. Distorted waves are known ex post. but not in advance. But correct detection of distorted waves as such helps to predict the next waves ending. If this wave is distorted again, reasoned by whatsoever, prediction failed again to some extent. This offers opportunity to critics to claim invalidity of results, which is to some extent true, but which does not necessarily mark the whole system as nonsense, since the next forecast might be extremely correct. Thus the system can be right in the long-run, but the investor might suffer from distortions in the short run. Actually, only comouter-testina could prove if it is possible to make money with the system. (Hence that todays knowledge about pattern recognition often refers to similar ideas, yet named differently and more modern). Moreover the critics should be aware, that even the best traders are right three to four out often bets, and never know why they were wrong. Elliott Waves can make you know why you failed, which includes a kind of element of self learning. Now after having introduced the basic structure it might be interesting to conclude similarities to modern theories. First of

1Э

to inhere — подразумевать

ae self-similarity — самоподобие

э: ei interpritation - интерпретация

i: to delete — стирать, удалять

all, the system inheres self-similarity, which is in the meanwhile well-introduced by chaos-theory approaches to financial markets.

Secondly there are similarities to modem pattern recogntion. since a five wave structure simply is—a pattern.

Thirdly, Fibonacci time series are quite modern as well and Elliott himself found the similarities astonishing:

"From my experience I have learned that 144 is the highest number of practical value. In a complete cycle of the shock market, the number of Minor waves is 144, as shown in the following table.

All are Fibonacci numbers and the entire series is employed. The length of waves may vary but not the number".

According to Elliott, the wave structure is including all activities of man. A.J. Frost and R.R. Prechtergo even further by claiming that the wave structure and its mathematical expression, the Fibonacci series, is a basic principle of the world as a whole.

The great variety of different interpretations of one wave and its meaning for the overall stmcture makes it rather impossible to computerize Elliott Wave without deleting some essential parts. Glenn Neelv tried to form a system which follows Elliott and works with full computer support, but he is often criticized for oversimplifying in order to computerize.

Compresension Questions

1. How does a rising stock market infold?

2. What is an impulse wave?

3. What can corrective waves form?

4. Does the increased number of movements change the technical significance of price pattern?

5. How do markets move according to Elliott?

6. What is the main problem which the analyst has to solve?

7. What makes wave — counting difficult?

8. Which wave is the most important for the investor and why?

9. Why is distorted wave detection extremely difficult?

Exercises

Ex. 1. Put questions to the underlined words.

Ex. 2. Draw up a plan of the article.

Ex. 3. Discuss the pros and cons of the Elliott wave theory. Ex. 4. Read and translate the text and the article.

Содержание